January 2025

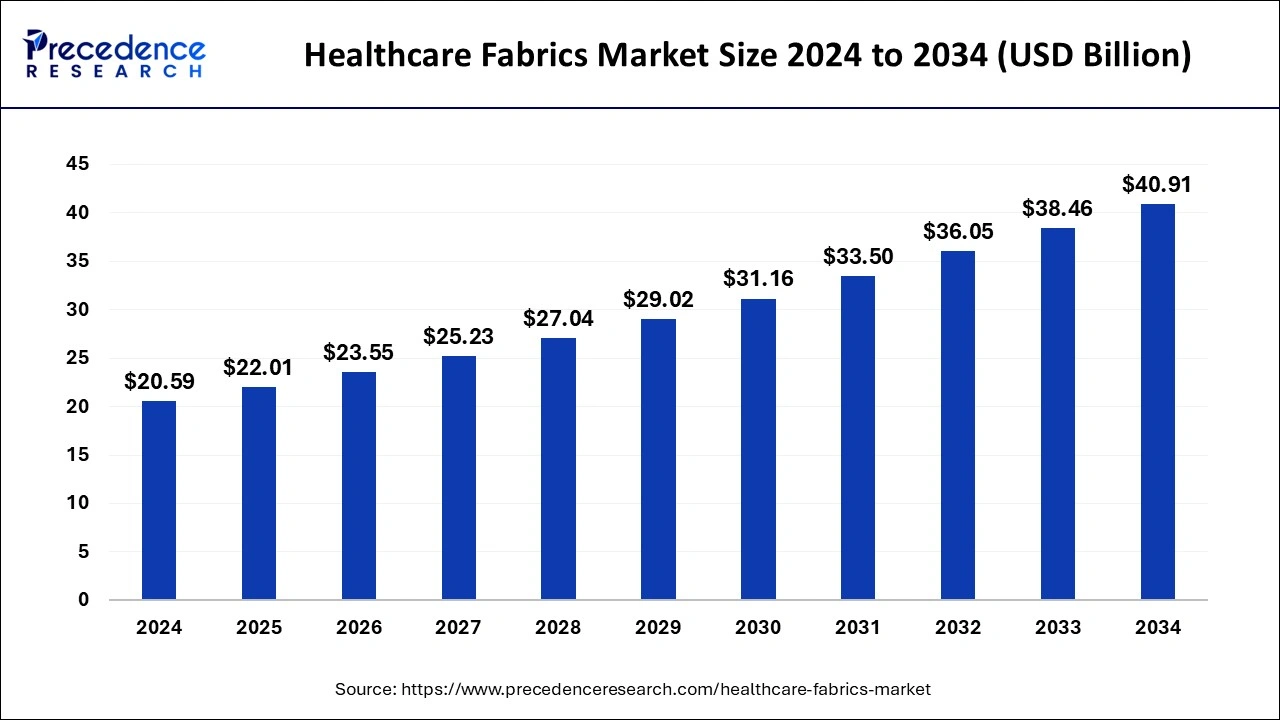

The global healthcare fabrics market size is calculated at USD 22.01 billion in 2025 and is forecasted to reach around USD 40.90 billion by 2034, accelerating at a CAGR of 7.10% from 2025 to 2034. The North America healthcare fabrics market size surpassed USD 7.21 billion in 2024 and is expanding at a CAGR of 7.25% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global healthcare fabrics market size was accounted for USD 20.59 billion in 2024 and is anticipated to reach around USD 40.90 billion by 2034, growing at a CAGR of 7.10% from 2025 to 2034. The rising innovations in developing eco-friendly healthcare fabrics, increasing investments and collaborations among industries along with the growing government support are driving the growth of healthcare fabrics market.

The integration of AI in healthcare fabrics helps in monitoring the health and vitals of the wearer. Sensors embedded in smart fabrics can applied for tracking physiological data such as heart rate and body temperature. AI algorithms and deep learning tools assist in analysing real-time data for providing insights, for quick response in emergency situations and in risk stratification.

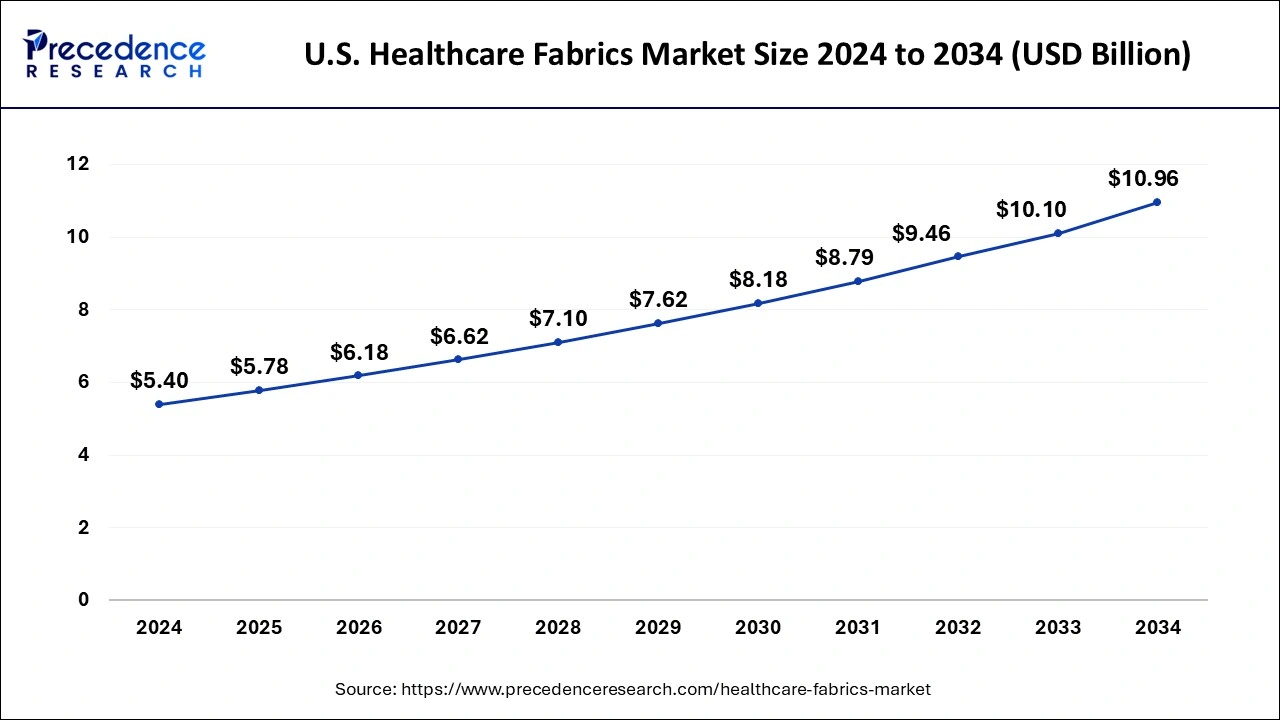

The U.S. healthcare fabrics market size was evaluated at USD 5.40 billion in 2024 and is predicted to be worth around USD 10.96 billion by 2034, rising at a CAGR of 7.33% from 2025 to 2034.

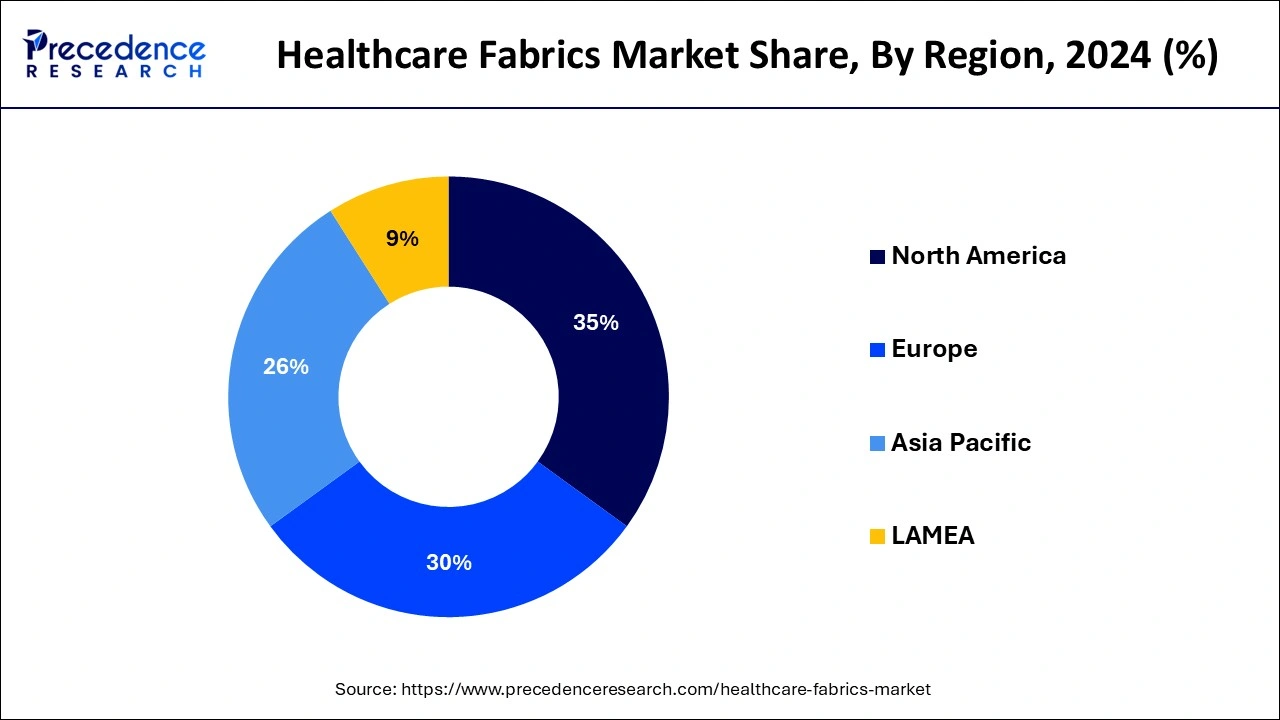

North America dominated the global healthcare fabrics market with the largest market share of 35% in 2024. The dominance can be attributed to several reasons, including the presence of a well-established healthcare system, constant investment & funding by the government, industry leaders, and other corporations. Hospitals and clinics constantly focus on providing patients with top-notch services, of which high-quality fabric is a part. Apart from this, North America is also technologically advanced, which has led the region to develop a healthcare fabric with sensors and devices to provide better status about the patients, ultimately leading to better patient care and patient satisfaction. The two major countries that are significantly contributing to the market's growth in North America are the U.S. and Canada.

The U.S. held the largest share of the healthcare fabrics market in North America in 2024, followed by Canada. The presence of major market players, investment in the healthcare systems, technology, growing patient demand for better services, the presence of organizations like the FDA, and continuous innovation by organizations are all responsible for the market's growth in the U.S. and Canada.

Asia Pacific is estimated to host the fastest-growing health fabrics market during the forecast period. The Asia-Pacific market for healthcare textiles is expanding significantly, mostly due to the growing popularity of feminine hygiene products. The Indian Nonwovens Industry Association claims that sanitary napkin market penetration in India has skyrocketed in recent years. There are a number of reasons for this increase in use, such as the availability of reasonably priced and cutting-edge products and the increased knowledge of proper hygiene habits. Positive government policies that encourage the use of safe and high-quality materials in healthcare applications are also helping the region's healthcare textiles industry. Furthermore, technological developments have been essential in driving this market's expansion by resulting in the creation of healthcare fabric solutions that are more effective and efficient. The Asia-Pacific healthcare textiles market is expanding due to a combination of favorable government regulations, rising use of feminine hygiene products, and technical developments.

| Report Coverage | Details |

| Market Size in 2025 | USD 22.01 Billion |

| Market Size by 2034 | USD 40.90 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 7.10% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Raw Material, Fabric Type, Application, End-use, Geography |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The polypropylene segment contributed the highest market share of 37% in 2024. Polypropylene has grown in popularity as a result of continuous advancements in medical procedures and textile technology. The largest end use prospect for disposable high quality non-woven materials is in hygiene and medical applications such as protective apparel for patients and infection free surgical drapes.

The cotton segment is projected to grow at a notable CAGR during the forecast period. Cotton has a number of qualities that make it ideal for use in healthcare. It’s absorbent, soft, and safe to use with all three basic sterilizing methods such as steam, ethylene oxide, and gamma radiation. Cotton can be utilized in the healthcare sector in its simplest form as 100% cotton as a fabric composite or combined with other fibers. Thus, cotton is used as healthcare fabrics on a large scale.

The non-woven segment dominated the global market in 2024. The demand for non-woven healthcare fabrics has grown due to the impact of COVID-19 pandemic. The face masks, personal protective equipment, and gowns are used for the protection against coronavirus outbreak. The government all around the world imposed stringent regulations for the use of such products, which had positive impact on the growth of the segment.

The knitted segment is expected to hit remarkable over the forecast period. As compared to woven healthcare fabrics, knitted healthcare fabrics are more effective and efficient in nature. The growing research and development activities are supporting the expansion of knitted healthcare fabrics segment.

The hygiene products segment has held a major market share in 2024. The products such as gowns, caps, face masks, pads, and sanitary napkins are categorized under hygiene products. The government of developed and developing regions is highly investing for the development of healthcare infrastructure. This is directly impacting the growth of hygiene products in the global healthcare fabrics market.

The dressing products segment is expected to witness fastest rate during the forecast period. The demand for dressing products is growing on a large scale due to accidents. The dressing products help in the protection of stitches and wounds of the patients. These products also help in lowering swelling and pain of the affected area of the body.

By Raw Material

By Fabric Type

By Application

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

December 2024

February 2025

April 2024